Filing your taxes is stressful enough; don’t worry about paying for it too! TurboTax offers free federal and state filing for qualified filers with Simple Form 1040 returns. Even better, they’ve launched a FREE Mobile option, so you can file from your phone! Switch to TurboTax and file with Do It Yourself free in the app by 2/28.

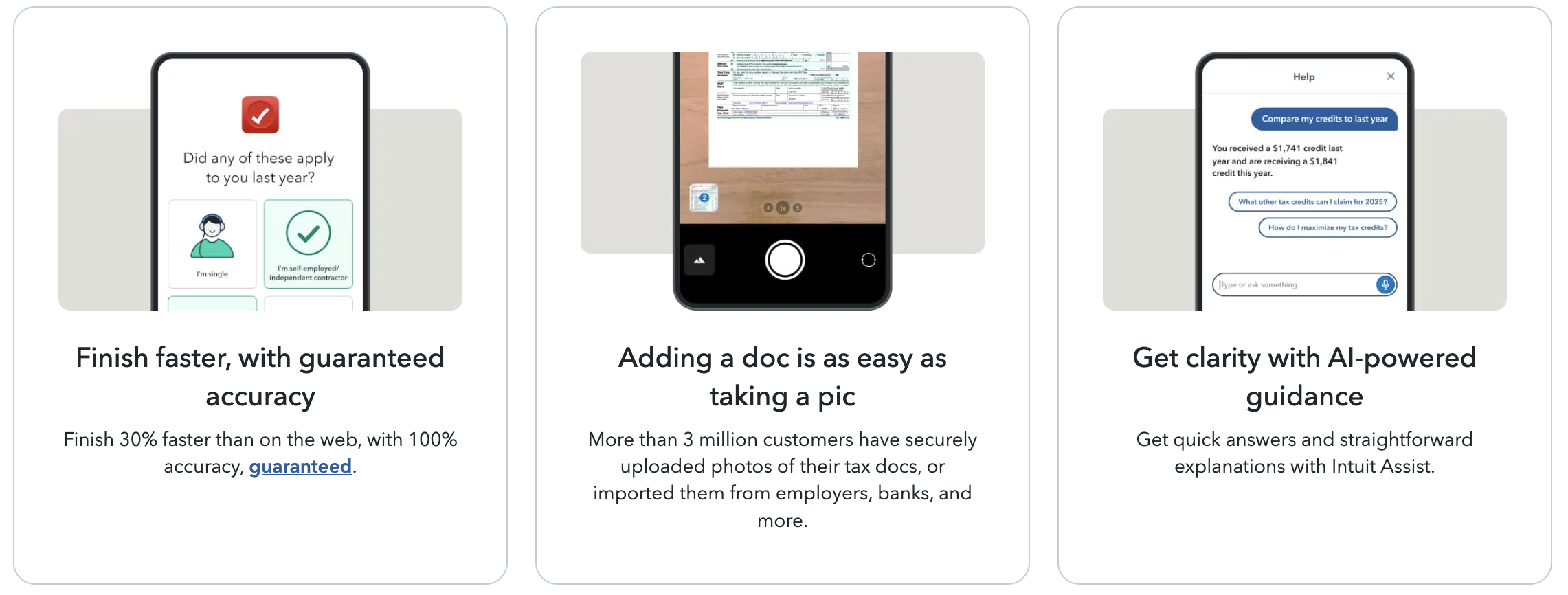

TurboTax makes it easy to file; they walk you through the process step-by-step while helping you look for any deductions to maximize your return. Working through your taxes, and an issue pops up? TurboTax has experts to help you with any questions you may have as you’re doing your taxes.

Not sure if you qualify for TurboTax’s free filing? Here are some examples –

- W-2 income

- Interest, dividends, or original issue discounts (1099-INT/1099-DIV/1099-OID) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

- Schedule 1-A deductions for qualified tips, overtime pay, car loan interest, and seniors (65+)

- Taxable qualified retirement plan distributions

Here’s how to qualify for TurboTax’s free app offer –

- Applies to federal and state taxes, all tax situations.

- This offer is valid only if you didn’t file with TurboTax last year.

- To qualify, start and file taxes in either the TurboTax or Credit Karma mobile app.

- This offer only applies to Do It Yourself—not to TurboTax Experts products.

- To redeem offer, taxes must be filed by 11:59pm ET on February 28, 2026.

Join The Discussion